Fortitude Financial Group Things To Know Before You Get This

Fortitude Financial Group Things To Know Before You Get This

Blog Article

Fortitude Financial Group Things To Know Before You Buy

Table of ContentsSome Known Questions About Fortitude Financial Group.More About Fortitude Financial GroupNot known Incorrect Statements About Fortitude Financial Group The 6-Minute Rule for Fortitude Financial Group

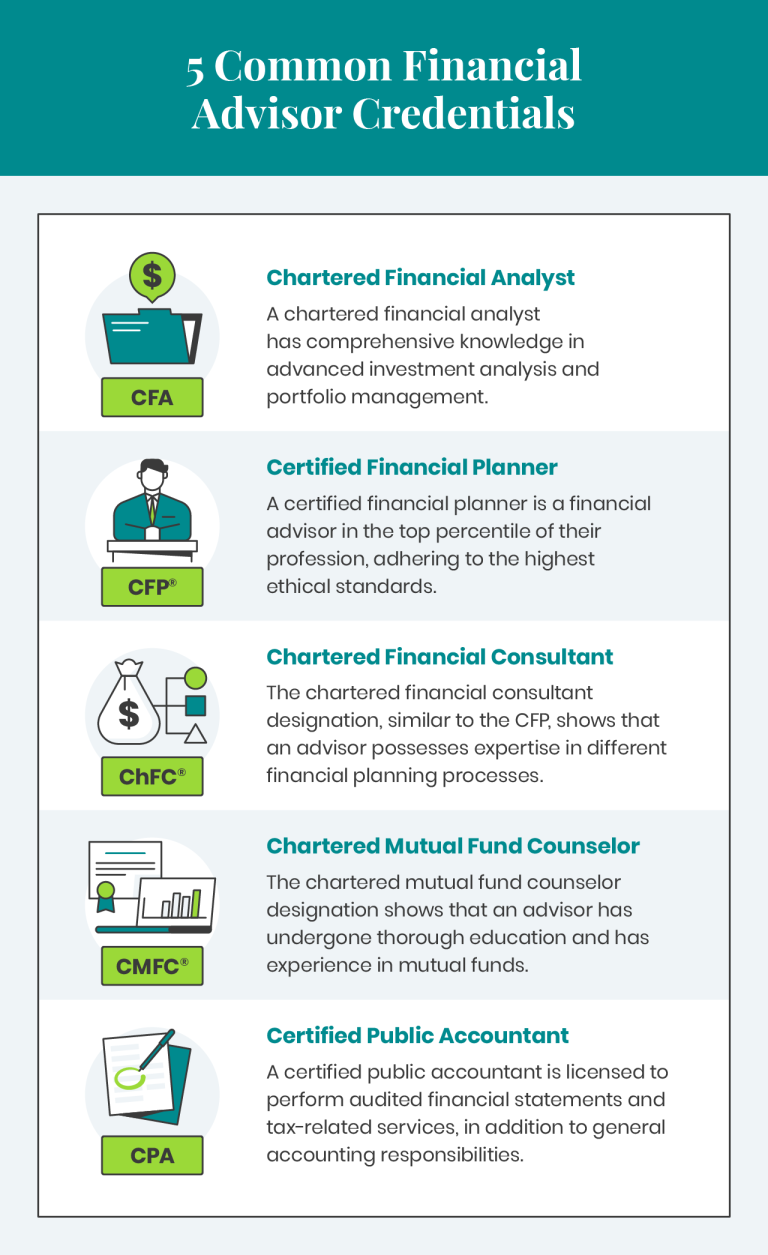

Some will examine your whole economic image and assist you create a detailed plan for achieving your financial objectives. Others, however, will certainly advise only the items they sell, which may offer you a minimal variety of selections. Unlike various other careers talked about in this area, the financial preparation profession does not have its very own regulatory authority.Various other planners may hold a credential that is even more hard to get and to keep, such as the CERTIFIED FINANCIAL organizer classification, or CFP, released by the Licensed Financial Planner Board of Criteria. This certification needs a minimum of three years of experience, enforces fairly strenuous criteria to make and preserve, permits capitalists to confirm the status of anyone asserting to be a CFP and has a corrective process

For instance, an insurance coverage agent will certainly tell you concerning insurance policy items (such as life insurance coverage and annuities) but most likely won't go over various other investment choices (such as stocks, bonds or mutual funds) - Financial Services in St. Petersburg, FL. You'll intend to make certain you totally comprehend which locations of your economic life a certain planner canand cannothelp with prior to you work with that individual

About Fortitude Financial Group

Any person can take advantage of skilled monetary adviceno matter where they're beginning with. Our monetary consultants will certainly check out your broad view. They'll think of all the what-ifs so you don't have to and overview you with life events big and small, like paying for college, buying a home, obtaining married, having a child, adopting a kid, retiring or acquiring possessions.

I approximate that 80% of medical professionals need, desire, and need to utilize a economic advisor and/or a financial investment supervisor. Some financial investment masters such as William Bernstein, MD, assume my estimate is method also low. Anyway, if you wish to use a consultant momentarily or for your entire life, there is no reason to really feel guilty concerning itjust ensure you are obtaining excellent advice at a reasonable price.

See all-time low of the web page for even more information on the vetting. At Scholar Financial Advising we aid physicians and individuals with complex monetary requirements by supplying economic suggestions that they can implement on a hourly project or monthly retainer basis. Our advisors hold at minimum a Ph. D. in Finance and Stephan Shipe, the firm's lead advisor, is also a CFA charterholder and CFP Professional.

The 5-Second Trick For Fortitude Financial Group

Together, we will certainly navigate the intricacy of daily life by crafting a structured monetary strategy that is dexterous for your evolving demands - https://pxhere.com/en/photographer/4349284. We will aid you utilize your riches to maximize time and energy to concentrate on your household, your practice, and what you like many. Chad Chubb is a Licensed Monetary Organizer (CFP) and Licensed Student Finance Professional (CSLP)

He established WealthKeel LLC to streamline and arrange the financial lives of doctors across the USA by custom-crafting economic strategies centered around their objectives and values. WealthKeel is identified by The White Layer Investor as one of a Home Page couple of select firms identified as "a great monetary consultant at a reasonable price," for their flat-fee membership version and additionally their capped fee structure.

($9,500) for All. Work together with us if: You're retired or will certainly retire in the following 7 years You have a total portfolio of $2M+ You're worried about producing & safeguarding earnings forever You desire to take care of the 10+ vital retired life earnings risks more proactively You don't like bothersome charge frameworks (% of properties, flat however tiered, commissions) We'll construct you a custom-made.

The Best Strategy To Use For Fortitude Financial Group

We can aid you develop a financial savings and financial investment strategy, so you recognize where to place your additional earnings. We can likewise aid with various facets of your economic life consisting of financial debt administration (trainee finance planning), tax preparation, and investment strategies. Our objective is to figure out the most efficient and adaptable method for clients to construct riches and reach their financial objectives.

Physicians have distinct economic issues that can occasionally feel frustrating. As locals, fellows, and early-career medical professionals, you deal with crushing student loan financial obligation and competing monetary objectives like starting family members and acquiring homes.

Report this page